Lending

In this example, we show how to create a transparent and efficient way for lending.

Introduction

We will now demonstrate how to develop a loan service using Ethereum smart contracts to provide a transparent and efficient alternative to traditional lending systems.

The loan service application can be used on any blockchain.

We define a loan as a sum of money or an asset expected to be paid back with interest. It can be a car loan or a mortgage, among other examples.

Benefits:

Trust and transparency: Loan terms, interest rates, and repayment schedules are recorded on the blockchain and cannot be altered, building trust among borrowers and lenders.

Lower costs: The automation applied can significantly reduce costs and paperwork associated with traditional lending, such as intermediaries and administrative overhead.

Faster transactions: By eliminating the delays associated with traditional loan approval, borrowers can access funds quickly, providing greater financial flexibility.

CBDC enhancement: The loan service can be used with a CBDC token contract.

Use Case: 'Ethereum loan service'

The loan application includes several endpoints to cover the user flow of a loan application, which we will explain in detail.

- We deployed a Quant smart token in Sepolia, an Ethereum smart contract representing the loan and its features.

- We used Overledger APIs to invoke smart contracts. For example, we called the 'contract write' endpoint to invoke the loan request by invoking different functions

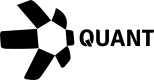

- Finally, we utilised our Overledger integration on Make.com and Zapier to manage notifications through emails which track smart contract events.

Users

Bob: Loan Manager

Laura: Loan Applicant

Initial set up

- Bob sets up a Zapier integration with Overledger to receive email notifications throughout the life of the loan. (As shown below)

- The notifications will be used to update internally and customers.

- Bob then configures a loan so it can be sold.

- With the loan service, Bob submits the loan requirements so that a smart contract representing the loan is deployed on the chosen blockchain network.

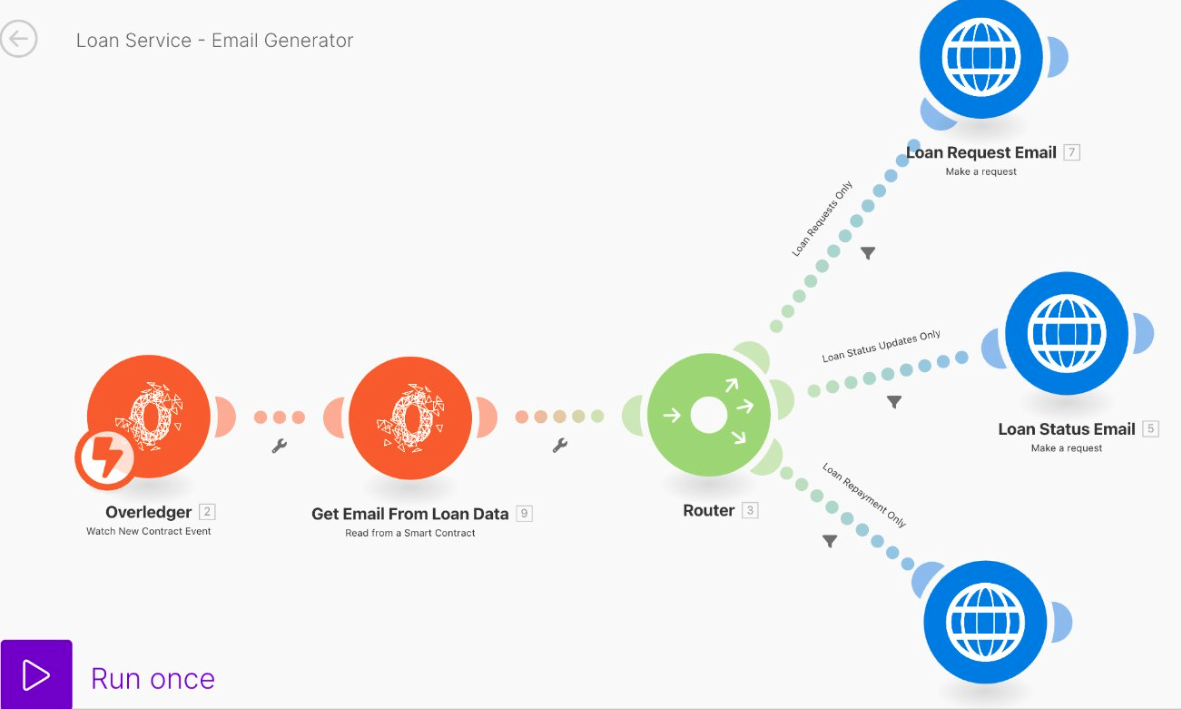

Here is an overview of the interactions

A loan service application was created to interact with the smart contract running on the selected node. The application is the user interface of the loan management lifecycle.

Below, you can view the interaction diagrams for each step of the lifecycle of a loan

Configure loan

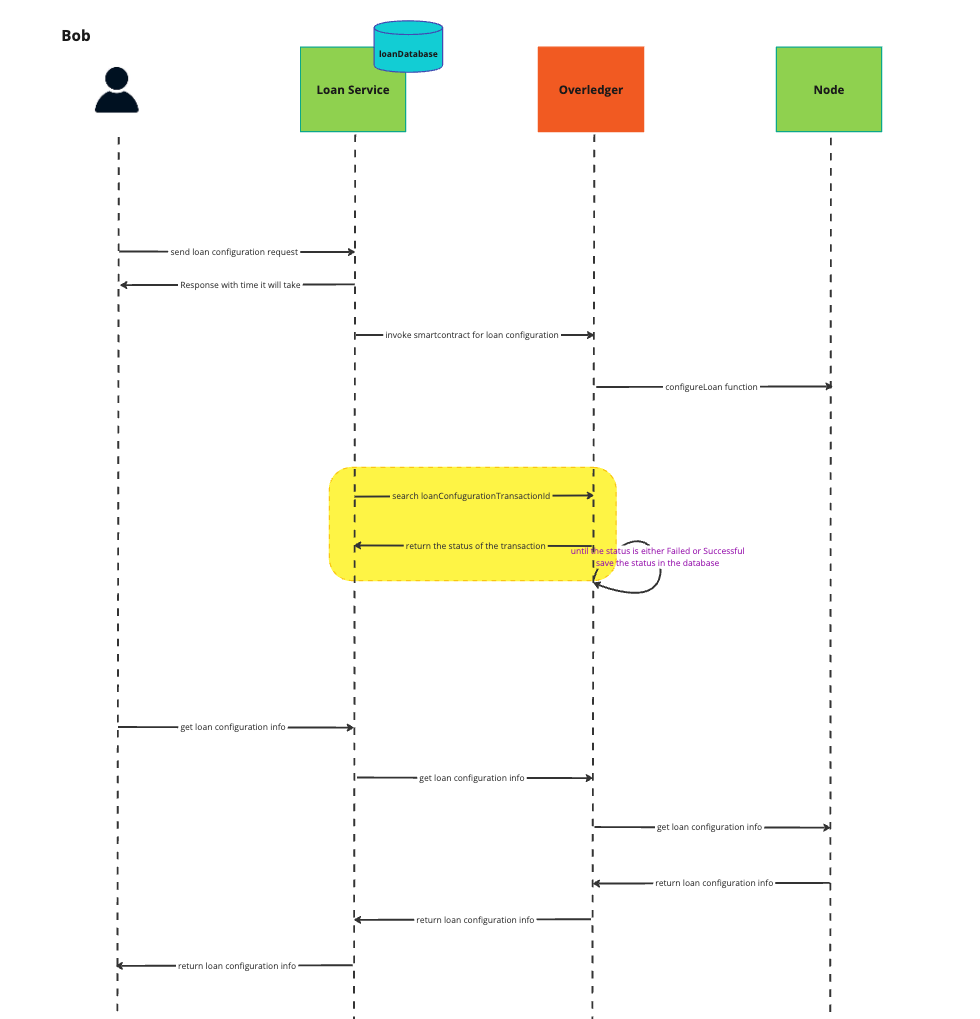

Request a loan

Once the loan is available. Laura wishes to apply for a loan to finance her new couch through the bank website.

This is the happy path where the loan has been approved.

Request loan repayment transaction flow

Laura can now start to repay her loan through the bank website. All repayments are captured on the smart contract.

Updated 8 months ago